Photo by Scott Graham on Unsplash

Simple Invoicing: A Comprehensive Guide to Expert Client Billing

Invoicing: An All-Inclusive Guide to Effective and Polished Billing for Clients

When it comes to managing your business sending invoices to customers is a task. It's crucial to create crafted and professional invoices that not only impact timely payments but also contribute to maintaining good relationships, with your customers. In this blog post, we'll delve into the practices for sending invoices that are easy to follow and exude professionalism.

Craft an Easy to Read Invoice Format Ensure that your invoice has an organized format making it easy for recipients to understand. Include details such as the date amount due accepted payment methods and your contact information. Utilizing invoicing software or online services can assist you in generating looking invoices.

Personalize Your Invoices Adding a touch can enhance the atmosphere of your invoices. Incorporate your company logo. Adopt a writing format that aligns with your company's identity. This personalized touch will help customers easily recognize your brand and bolster their confidence in doing business with you.

Send Invoices Promptly To optimize payment processes and minimize issues arising from delayed invoice delivery make sure to dispatch invoices as soon as you have delivered the product or completed the service for the customer. Sending invoices increases the likelihood of payments.

Choose an Efficient Delivery Method Consider means of delivering invoices based on what's most convenient for your customers—email, mail or even instant messaging apps if they feel comfortable using them.

By following these practices you can ensure that your invoice management process is efficient and maintains an image while nurturing positive relationships, with your customers. To ensure a payment process it's important to determine the efficient way of delivering your products or services based on your customers needs.

It's crucial to provide detailed information, about the products or services in the invoice. This includes descriptions, quantities, unit prices and total prices. By doing you help customers understand what they're paying for and avoid any confusion or additional queries.

Offering payment options can also facilitate payments. Consider providing methods such as bank transfers, credit cards or online payment applications. Make sure to include instructions on accepted payment methods and ensure that all necessary account information is readily available on the invoice.

By following these practices when sending invoices to customers you'll not maintain a healthy relationship with your clients but also enhance your business success. Remember to create invoices that're easy to read looking and inclusive of all relevant information needed by customers for their payments. Wishing you success, in all your business endeavors!

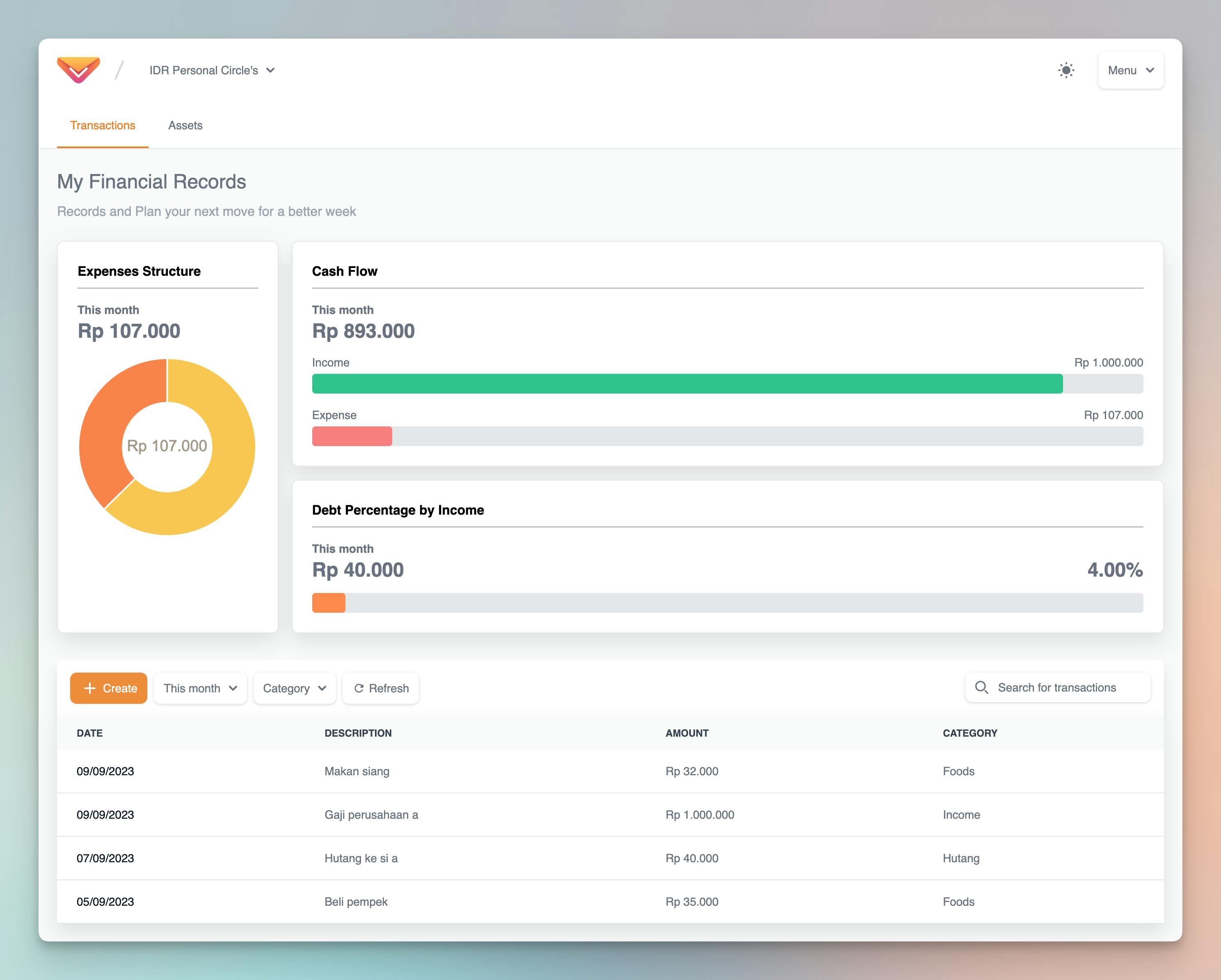

Introducing Inving - A Platform for Evaluating Your Expenses

Understanding our finances is incredibly important especially when it comes to examining our expenses. It's crucial to have an understanding of where our money is being spent and identify areas where we can improve our spending habits. This is where Inving comes in – it's an expenses tracker template that helps us stay on top of our expenses and make informed decisions.

When considering alternatives, for tracking expenses using Excel, Inving truly stands out as a solution. It's not your tool, it's a free personal expenses tracker that allows you to keep track of your spending without any additional charges.

Moreover, Inving serves as the budgeting app for couples enabling them to manage their joint expenses transparently. It goes beyond expense tracking. Also offers features for efficient portfolio management.

With Inving managing your investment portfolio becomes effortless and precise making it an inclusive tool, for all your needs.