Tips, for Saving Money and Effectively Managing Your Income

Learning how to save money is a life skill that can provide security and independence. It's not about setting aside a portion of your earnings; it involves making choices understanding your spending habits and effectively managing your income. Here are some practical tips on saving money and allocating your income based on what you earn.

Assess Your Spending Patterns

The first step towards saving money is gaining insight into where your money goes. Take a look at your bank statements. Categorize your expenses. This includes essentials like rent or mortgage payments, utilities, groceries, and transportation as discretionary spending such as dining out entertainment and shopping.

Once you have an understanding of your spending habits consider eliminating commitments. You might be subscribed to services that are no longer useful or necessary. Evaluate these subscriptions. Cancel the ones you can do without.

Develop a Budget and Stick to It

Once you've identified your expenses create a budget that reflects both your income and expenditures. Make sure to include a category for savings, with the goal of setting 15 to 20 percent of your income if possible. This budget will assist you in planning how you spend while also preventing overspending.

Smart Shopping

To ensure you're getting the deal, on products and services it's a good idea to use price comparison websites. There can be a difference between the most expensive providers so comparing prices is definitely worth it. You can check out which.co.uk for this purpose.

When it comes to items like clothing, furniture or electronics consider exploring second-hand options. Many online marketplaces offer second-hand items that are in condition at a fraction of their original price. You can find some deals on which.co.uk.

Save on Food and Entertainment

Eating out frequently can quickly add up expenses. One way to save is by cooking meals at home and treating dining out as an occasion. Whenever you do decide to dine out make sure to look for deals and discounts. Many restaurants promote offers through their social media channels or websites so keep an eye out on which.co.uk.

For entertainment purposes try seeking low-cost activities within your community. Many cities organize events like concerts or movie nights that you can enjoy without breaking the bank. Check bettermoneyhabits.bankofamerica.com for events in your area.

Make Your Money Work for You

It's worth considering strategies to make your money work harder for you. If you have a savings account take a look at the interest rate it offers and think about switching to an account with rates if available. Some providers tend to offer rates for new customers according to which.co.uk.

Another way to earn income is by exploring possibilities, like renting out your parking space or selling items online. Engaging in activities can significantly increase your income as mentioned on which.co.uk.

Conclusion

Savings don't have to be overwhelming. By being aware of your expenses setting a budget being a shopper and making financial choices you can enhance your financial well-being and establish a stable future. It's essential to remember that even small savings accumulate over time.

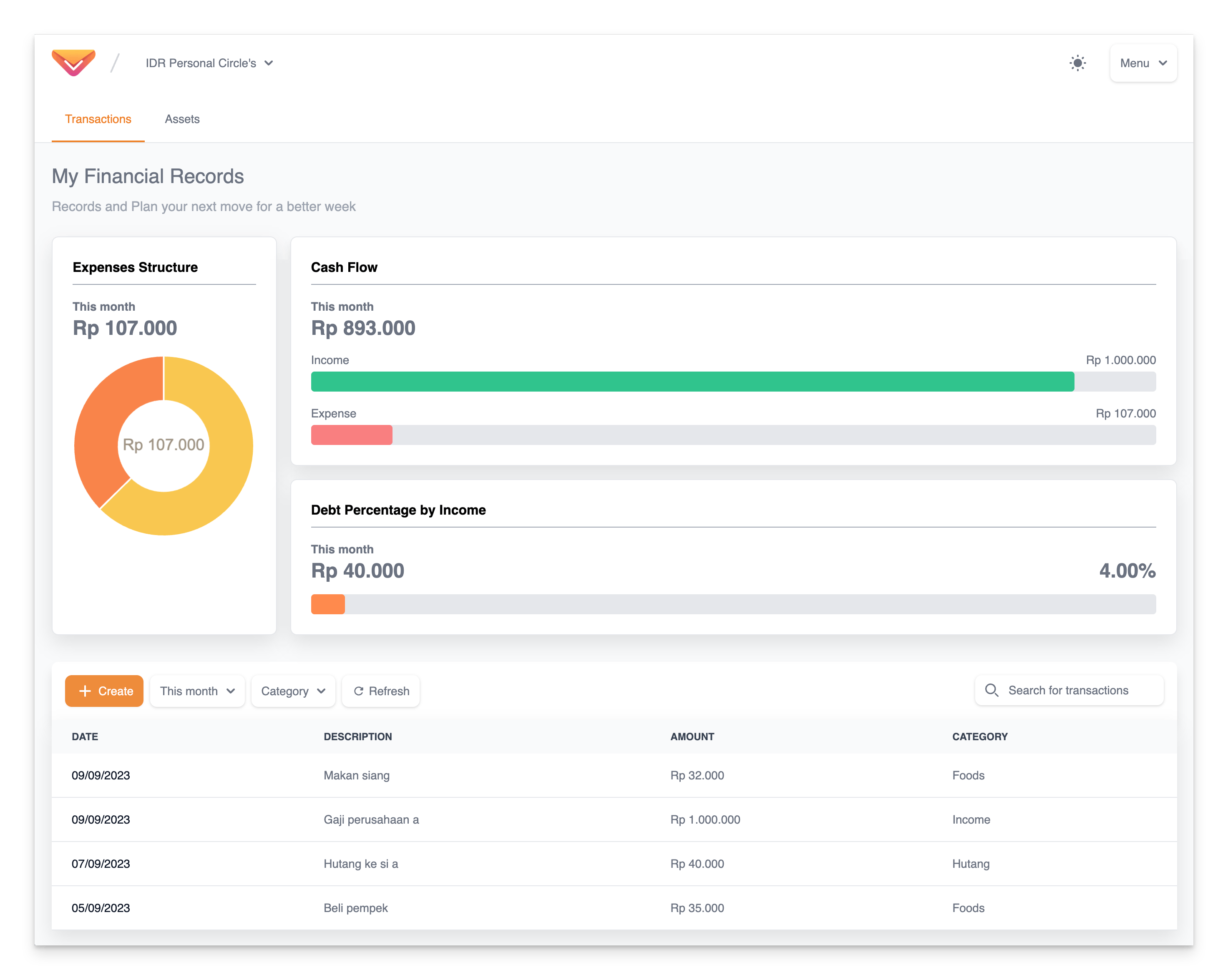

Introducing Inving - A Platform for Evaluating Your Expenses

When it comes to handling our finances a vital aspect is examining our expenses. It's important to comprehend where our money is being spent and pinpoint areas where we can enhance our habits. This is where Inving steps in. A tool crafted to assist you in gaining oversight of your expenses and making well-informed choices regarding your finances.