Essential Retirement Planning: Practical Tips for a Secure Future

Understanding Retirement Planning: The Foundation of a Secure Future

Retirement is a phase of life that everyone looks forward to, a time when you can finally relax and enjoy the fruits of your hard work. However, a comfortable retirement doesn't happen by chance; it requires careful planning and wise financial decisions. In this blog post, we will guide you through some essential steps to create a good retirement financial plan.

Understanding Retirement Planning

Retirement planning involves evaluating your current financial standing and creating an income strategy that can support your lifestyle once you stop working [1]. It's about setting goals, assessing your expenses, and ensuring that you have enough savings and investments to cover these costs when the time comes.

Key Steps to Retirement Planning

Establish a Retirement Plan: Determine when you want to retire and how much you need to save to sustain your desired lifestyle. The earlier you start planning, the more time your money has to grow [1].

Set Aside Regular Savings: Automate your savings to ensure consistency. This way, you can avoid the temptation of skipping or forgetting to deposit money [1].

Choose the Right Investment Accounts: If your employer offers a 401(k) or similar account, consider investing in it. This not only provides you with a tax advantage but also allows you to benefit from any employer match, which is essentially free money [1].

Regularly Review Your Investments: Your financial situation and goals may change over time, so it's crucial to periodically review and adjust your investments accordingly [1].

Practical Tips for Retirement Planning

Estimate Your Retirement Income: Calculate your likely retirement income, including state pensions, defined benefit pensions, and defined contribution pensions. You can use online tools to predict your retirement income based on your current savings and investment strategy [1].

Track Your Pensions: If you've lost track of any old pensions, use the Pension Tracing Service to find them [1].

Consider Your Lifestyle: Think about the kind of lifestyle you want during retirement. Do you plan to travel extensively, or do you want to explore local areas? Your lifestyle choices will significantly impact your retirement costs [2].

Plan for Healthcare Costs: Healthcare can be a significant expense in retirement. Consider investing in health insurance or setting aside funds specifically for health-related costs.

Have an Emergency Fund: An emergency fund can provide financial security in case of unexpected expenses. Aim to save enough to cover at least three to six months' worth of living expenses.

Stay Informed: Keep up-to-date with financial news and trends. Follow retirement blogs and financial advisors to stay informed about strategies and tips that could benefit your retirement planning [3].

Remember, retirement planning is a long-term process, and the financial decisions you make today can significantly impact your future. Start planning now to ensure a comfortable and secure retirement.

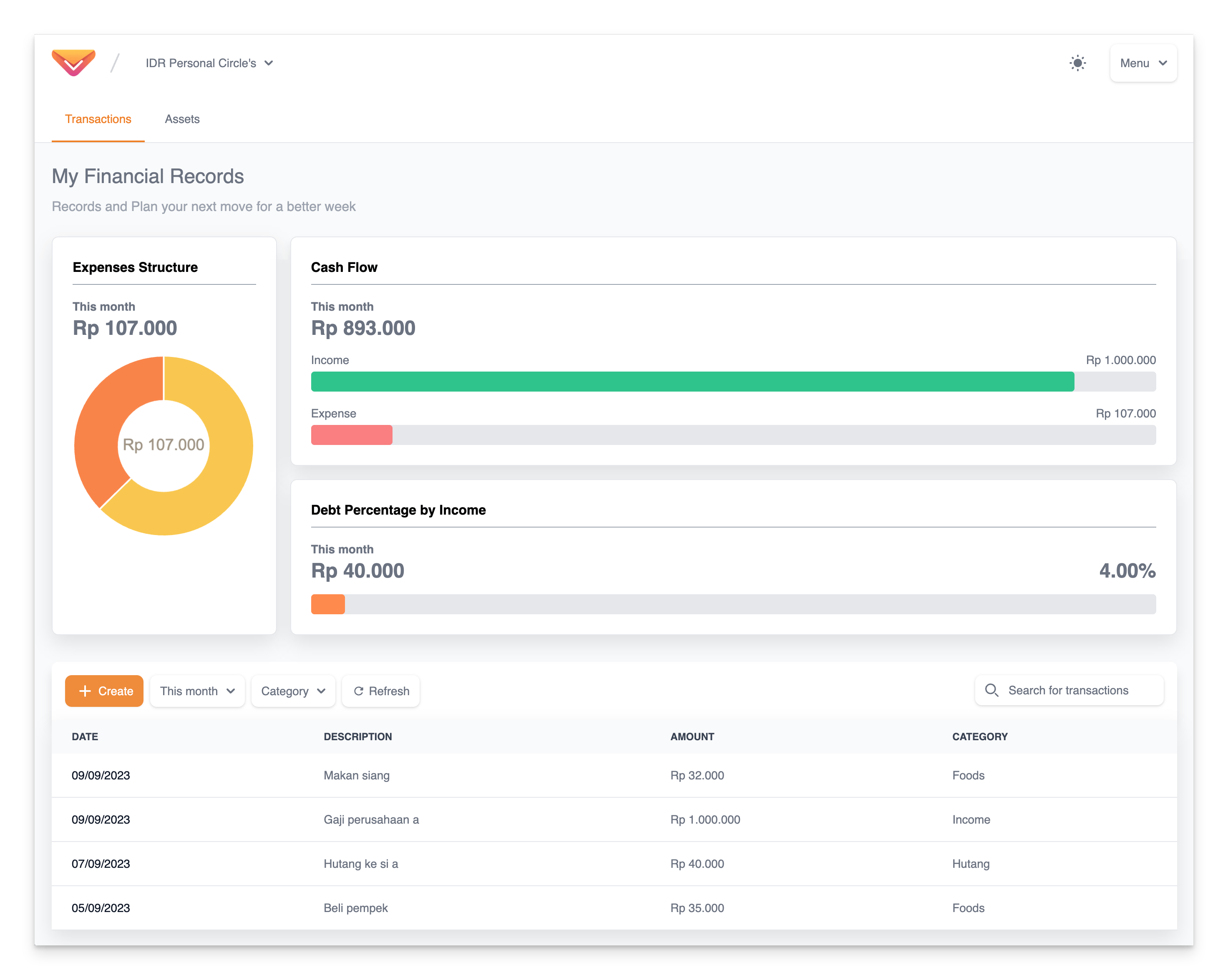

Introducing Inving - A Platform for Evaluating Your Expenses

When it comes to handling our finances a vital aspect is examining our expenses. It's important to comprehend where our money is being spent and pinpoint areas where we can enhance our habits. This is where Inving steps in. A tool crafted to assist you in gaining oversight of your expenses and making well-informed choices regarding your finances.