Photo by Ashraful Islam on Unsplash

Achieving Financial Success through Efficient Management of Assets and Tracking Expenses

Getting a grasp, on the fundamentals of portfolio management, expense tracking and investment strategies

In the world of finance asset management plays a role, in both growing and protecting a client's wealth. Financial professionals, also known as asset managers take on the responsibility of overseeing their client's money and securities. They leverage their expertise and market knowledge to increase the value of their clients' investments. These strategies can involve types of investments such as exchange-traded funds, real estate properties, fixed-income securities or stocks.

At the heart of asset management is portfolio management, which involves managing a collection of investments held by individuals or institutions. The main goal is to find a balance between risk and return by diversifying investments across asset classes. This means spreading investments across sectors, geographic regions and types of assets in order to minimize risk while maximizing returns for clients [0].

When it comes to investing managing expenses is essential for maintaining stability. Here are some practical suggestions for handling expenses:

Budgeting; Creating a budget serves as the foundation for expense management. It allows individuals to track their income and expenses identify areas where they may be overspending and make adjustments to achieve their goals. Utilizing an expenses tracker template or an alternative like an expenses tracker Excel can be incredibly useful, in this regard.

When it comes to managing expenses it's important to distinguish between needs and discretionary wants. By understanding this difference individuals can effectively allocate their resources.

One way to free up funds, for investments is by reviewing and minimizing expenses. This could involve cutting back on purchases negotiating deals on bills and services or finding more cost-effective alternatives.

To ensure contributions without effort it's beneficial to automate transfers to savings and investment accounts. This helps individuals stay on track with their goals.

If you're looking for assistance with these strategies there are plenty of personal expense trackers available [1]. Additionally for couples managing their finances together a budget app can be a game changer. These apps make it easy to track and categorize expenses set shared goals and plan for expenses. They can also provide insights into spending patterns that help couples make decisions about their finances [2].

In conclusion, having an understanding of asset management principles and investment portfolio management can guide individuals towards making investment choices that grow and protect their wealth in the long run. Building a portfolio seeking guidance when necessary and effectively managing expenses are steps, towards achieving lasting financial stability. It's wise to seek guidance from an advisor or asset manager to making any investment choices. They can provide insights based on your situation assisting you in developing a well rounded investment strategy that aligns with your unique goals and requirements [0][1].

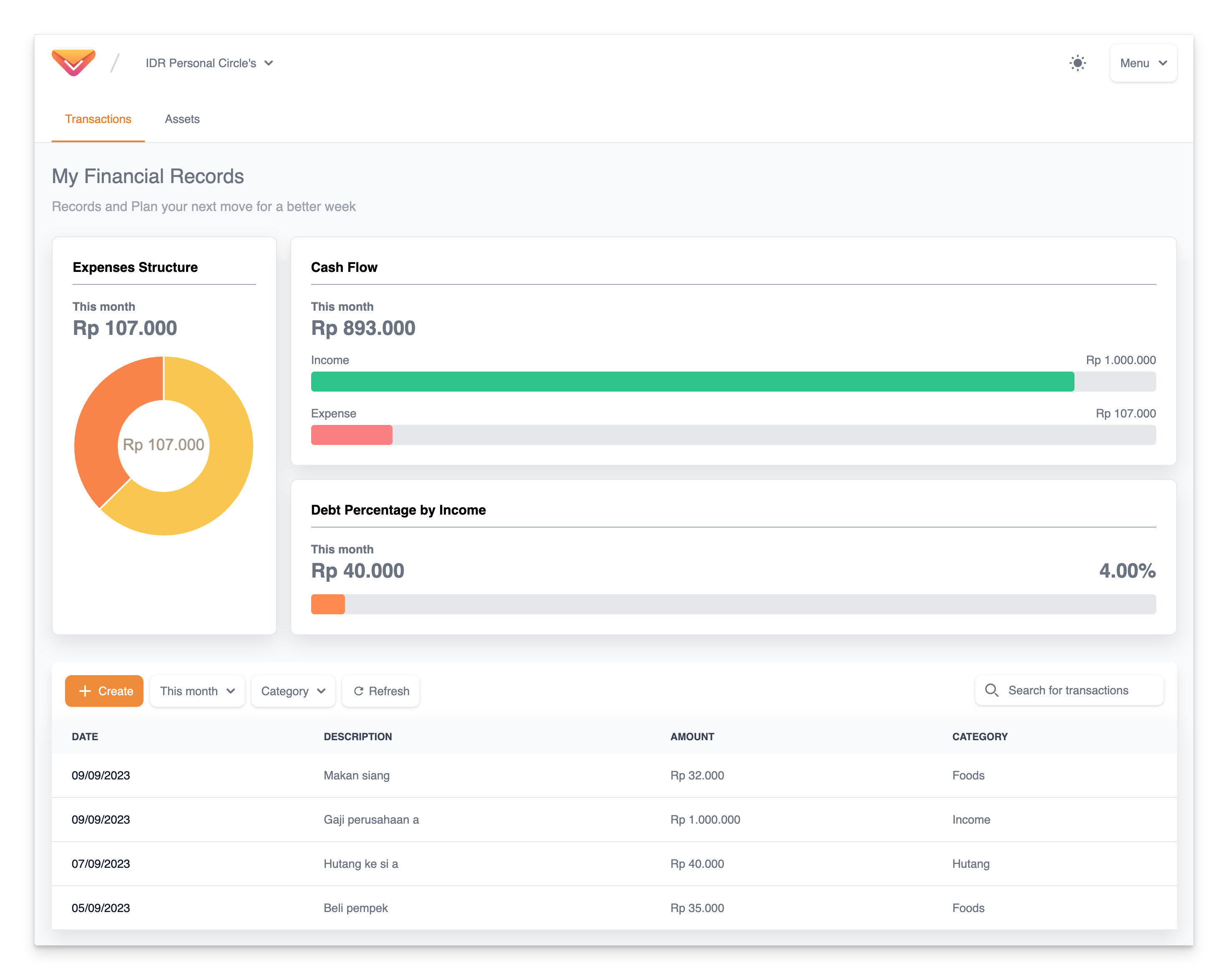

Introducing Inving - A Platform for Evaluating Your Expenses

Understanding our finances is incredibly important especially when it comes to examining our expenses. It's crucial to have an understanding of where our money is being spent and identify areas where we can improve our spending habits. This is where Inving comes in – it's an expenses tracker template that helps us stay on top of our expenses and make informed decisions.

When considering alternatives, for tracking expenses using Excel, Inving truly stands out as a solution. It's not your tool, it's a free personal expenses tracker that allows you to keep track of your spending without any additional charges.

Moreover, Inving serves as the budgeting app for couples enabling them to manage their joint expenses transparently. It goes beyond expense tracking. Also offers features for efficient portfolio management.

With Inving managing your investment portfolio becomes effortless and precise making it an inclusive tool, for all your needs.